Navigating Homeowners Insurance for Solar System Owners

Last updated at

As the sun's rays power our homes, installing solar panels becomes a crucial investment in clean energy. However, unforeseen events, from hailstorms to theft, can pose risks to this valuable asset. This guide explores proactive measures to minimize homeowners insurance claims related to solar panel losses.

Homeowners must understand coverage nuances in order to avoid surprises. Thinking ahead in implementing protective measures reduces potential risks. This helps extend the longevity of your solar energy investment.

Let's dive into the strategies to safeguard your solar panels and minimize the impact of unexpected losses on your homeowner's insurance.

What are the statistics

In 70-80% of cases, a rooftop solar panel is considered a permanent attachment to your home and fall under the dwelling coverage of your homeowner's insurance policy. This means they're automatically protected against covered perils like:

Fire: According to the National Fire Protection Association, solar panels have a 0.02% chance of causing fires, significantly lower than traditional electrical systems.

Hail: Studies by the National Renewable Energy Laboratory (NREL) show modern panels can withstand up to 2 inches in diameter hailstorms. However, most solar panel warranties only claim to withstand 1-inch hail.

Wind: NREL research indicates most panels can endure winds up to 130 mph without damage. However, specific wind coverage may vary by location and policy.

Theft: Although rare, some policies cover theft of panels, especially if they're individually serialized.

Potential concerns of solar owners

Ensuring your homeowner's insurance covers your solar panel investment is a smart move. It guarantees proper replacement value and guards against return to high priced electric bills. Keep your protection up-to-date to enjoy the benefits of sustainable living worry-free.

Here are some factors you should consider to reduce homeowners insurance claims for solar panels:

Types of Losses That May Occur:

Damage from hail storms can break solar panel glass: Solar panels, basking in sunlight on rooftops, fall prey to hailstorms. Hailstones shatter glass, leaving broken glass that hinders energy generation. The aftermath demands swift repairs and hefty costs to restore their efficiency post-storm resilience test. Wind or hail, homes and businesses can protect their solar panels with the Hail Blocker Net.

Impacts from errant golf balls and baseballs can break panel glass: Errant golf balls and baseballs pose a significant risk to panel glass, as their high velocities and hard surfaces can lead to breakage upon impact. The force generated by a golf ball or baseball can easily surpass the structural integrity of the glass, causing cracks or shattering. The kinetic energy transferred during a direct hit can result in immediate damage, compromising the safety and functionality of the glass panels. Protective measures, such as barriers or netting like Baseball Catcher Net and GolfNet, are often essential to mitigate the potential hazards associated with errant sports projectiles and safeguard surrounding areas from the destructive consequences of impacts.

Rocks thrown by lawn mower and weed trimmers can easily break solar panel glass: Beware! Rocks propelled by lawn mowers and weed trimmers pose a serious threat to your solar panels. The high-speed impact can easily shatter the delicate glass surface, leading to costly damages. Safeguard your investment by installing a durable solar panel protection net from SolarNets Shielding your panels ensures a longer lifespan and uninterrupted energy production. Act now to prevent potential breakage and keep your solar power system running smoothly.

Accumulation of bird poop caused by birds roosting under solar panels can cause roof leaks, particularly on homes with tile roofs: Birds roosting under solar panels can lead to an unexpected issue for homeowners, especially those with tile roofs. The accumulation of bird poop poses a risk of roof leaks over time. The acidic nature of the droppings may damage the roofing material, making it vulnerable to water penetration. To address this problem, solar panel protective covers can be a practical solution. These covers create a barrier between the panels and the birds, preventing direct contact with the roof.

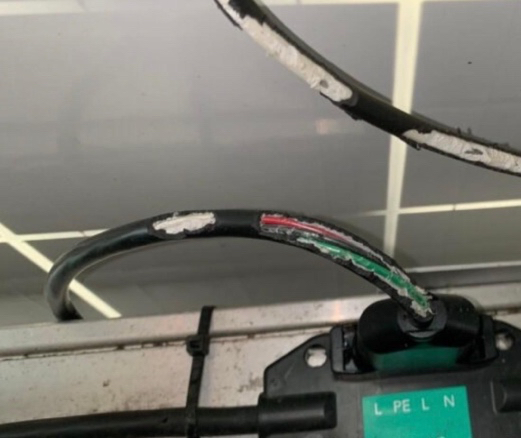

Rodent damage by chewing of wire insulation: Rodents, like mice and rats, often chew on wire insulation, causing safety hazards and damage to electrical systems. To prevent this, solar nets, protective coverings made of durable materials, can be installed around solar panel wiring. These nets create a barrier, deterring rodents from chewing through the insulation and ensuring the safety and longevity of the electrical system.

Understanding existing coverage in simple steps

The first step:

- Review your current homeowners insurance coverage policy

- Identify dwelling coverage limits

- Check for exclusions related to solar panels (e.g., hail, theft)

- Confirm coverage applies to ground-mounted solar panels (if applicable)

- Contact your insurance provider

- Discuss your solar panel installation plans

- Ask about automatic coverage extension for panels

- Clarify any potential adjustments needed for dwelling coverage

Assessing coverage needs

Keep the following factors in mind:

- Value of your solar panels

- Determine the replacement cost for system and components.

- Consider potential increase in home value due to panels.

- Expand coverage amount to include the replacement cost of your solar system

- What is the monthly financial loss if your solar system is off-line

Additional coverage options

- Theft & vandalism: Assess risk and need for dedicated coverage.

- Production loss: Evaluate potential financial impact of panel downtime.

- Extended warranties: Compare offerings from installers and insurers.

- Wind Damage: Some insurers specifically disclude losses due to wind related damages.

- Hail Damage: Some insurers specifically disclude losses due to hail.

Steps you can take to reduce risk of losses

Informing your insurance company of your loss-prevention steps may help you get a lower price for insurance. Follow these steps to prevent solar panel losses and a hefty replacement cost.

Install solar panel protective nets to deflect falling objects like golf balls and baseballs ( a must if you live near a golf course or baseball field). Choose premium quality products like those provided by SolarNets.com.

Add bird block wire mesh to keep birds and rodents from getting below solar panels. Products like those provided by Bird Barrier

Install tamper-resistant screws on solar panel clamps to prevent panel theft from ground mounted arrays. Available from ProSolar Inc and SunnyCal Solar Inc

Record the model and serial number of your solar equipment

Have periodic inspections to prevent surprise losses (companies like Solar Servco have maintenance plans)

Comparing insurance providers:

Remember to gather multiple quotes

Request a home insurance quote from your current company and other competing insurance companies.

- Specify details of your existing policy and solar panel system.

- Compare homeowners insurance coverage options, deductibles, and premiums in the quote

Consider insurance company factors:

- Financial stability & ratings of the company.

- Experience handling solar panel claims.

- Customer service & claims processing reputation.

Making your decision:

Balance coverage amount the premium versus cost.

Verify comprehensive coverage protecting your solar investment.

Choose a reputable insurer with experience in solar claims.

Additional considerations:

State-specific regulations: Certain states may have specific requirements for solar panel coverage.

Solar installer recommendations: Consult your installer for potential insurance partners or endorsements.

Regular policy review: Schedule annual reviews to adjust coverage as needed.

Remember, this is a general outline and your specific needs may vary. Always prioritize consultation with qualified professionals like your insurance agent and solar installer for personalized guidance.

Before you sign on the dotted line

Make sure you:

Review Your Policy: Before installing panels, thoroughly review your homeowners insurance policy to understand your current coverage and potential exclusions.

Consider Additional Coverage: Depending on your needs and specific policy, you may want to explore separate coverage options for theft, production loss, or extended warranties.

Take Steps to Reduce Possibility of Damage: Adding protective items like bird blocking wire mesh, tamper proof screws and protective barrier nets.

Contact Your Insurance Provider: Discuss your solar panel plans with your insurance company agent to confirm coverage and potentially adjust your dwelling coverage amount. Do not forget to mention any protective measures you will be installing.

Note: Each insurance policy and company is unique. Always prioritize communication with your provider for the most accurate and up-to-date information regarding your coverage and needs.

By understanding the nuances of solar panel coverage and taking proactive steps, you can confidently enjoy the benefits of clean energy while protecting your valuable investment.